Client Bulletin Board

B2E Solutions Hours

B2E regular hours are M-Th (8a-5p CST) and Fri (9a-3p CST)

Important I-9 Info

- Employers can continue to use either of the two previous editions (dated 8.1.23) until the valid expiration dates of 7.31.26 or 5.30.27.

- The newest form is currently reflected in E-Verify and E-Verify+. It will also be updated in UKG Ready with the 7.23.25 system update (R100).

(New) Tax Registration Filing Service

B2E now offers a tax registration filing service.

Hiring employees in new states requires you to comply with state employment laws, which include registering for required tax accounts. The process can be time-consuming, confusing and prone to expensive errors. For just $175 per registration, B2E can handle the filing process for you.

(New) Managed Payroll Services

Ready to get off the payroll processing treadmill? Contact your Client Success Manger to learn about how our Managed Payroll Services offering can save you time. We’ll handle all of the most time-consuming, cumbersome responsibilities that come with administering payroll, so you can focus on more strategic, business-driving work.

Remember to update your Labor Law Posters

Employers are required by law to post labor law posters in the workplace, as well as online for remote employees. If you haven’t updated your labor law posters, now is the time.

If you want to automate your postings once and for all, we have a Poster Service that will proactively provide you with federal, state, city and county labor law postings and updates you need to remain compliant and protected from government fines and penalties of up to $25,000.

To learn more about this Poster Service, please reach out to your CSM.

Paid Family and Medical Leave Insurance (PFML) Requirements

Many states require that employers offer paid PFML insurance, which provides wage replacement to employees taking leave to care for an ill family member or to bond with a new child.

As employers are increasingly hiring remote employees, it’s important to take note of state PFML requirements.

Check out our recent blog to learn more about the state-by-state PFML requirements and the payroll implications for your organization.

The following states currently require or will soon require employers to provide PFML:

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Maine (effective May 1, 2026 for employee benefits; employee contributions are active)

- Maryland (Jan 2027 or later)

- Massachusetts

- Minnesota (effective Jan 6, 2026)

- New Jersey

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

- Washington, D.C.

Earn Payroll Credits

We want more great clients like you! If you have a friend or business associate that would benefit from working with us, send them our way and we’ll reward you with a payroll credit when they become a client.

We're Hiring

B2E Solutions is growing! Know someone who would be a great fit at our organization? We’re hiring for multiple remote or local (Hartland, WI) positions and are looking for new-hire referrals.

Please share our career board with any remarkable candidates. We’d love to talk to them about their experience and interest.

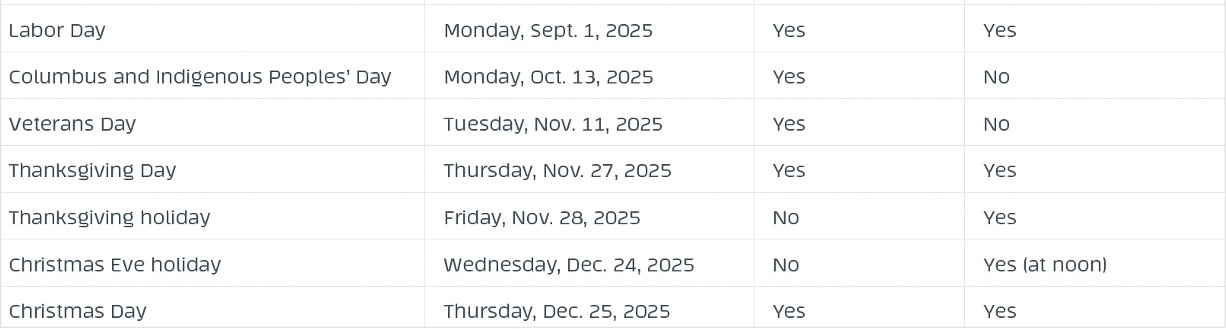

Holiday Schedules

Please schedule your payroll processing and pay dates around bank closings and be aware of upcoming B2E Solutions closings, so you do not encounter unexpected delays.

We want to hear from you!

Please submit any feedback (good or bad) to our client service managers.